This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to the start of the working week. Here’s what’s on the agenda today:

-

Trump holds crunch shutdown talks

-

First Brands files for bankruptcy

-

The graduate ‘jobpocalypse’

-

And skiing in British Columbia’s wilderness

Donald Trump will meet congressional leaders today for crunch talks as the threat of a costly government shutdown looms over Washington. Here’s what you need to know.

Who will attend? Leaders from both parties will meet the president at the White House. Chuck Schumer, leader of the Democrats in the Senate, and Hakeem Jeffries, the top opposition politician in the House, will both be at the meeting with Trump after previous meetings were cancelled. Speaker of the House Mike Johnson and John Thune, the top Republican in the Senate, will also be at the discussions to avoid a government shutdown at the end of tomorrow. “If they don’t make a deal, the country closes,” the president told Reuters. “So I get the impression they want to do something.”

What’s being discussed? Republicans have put forward a plan to keep the government temporarily funded through November 20. They have argued their plan is a “clean” continuing resolution, meaning that it broadly keeps the government funded at current levels. But Democrats have said they will only sign up to a deal that extends tax credits linked to the Affordable Care Act, or Obamacare, that are due to expire at the end of the year. Republicans have claimed that Democrats want to give undocumented migrants hundreds of billions of dollars in healthcare benefits. Here’s more on what to expect.

Here’s what else we’re keeping tabs on today:

-

Trump-Netanyahu meeting: Israeli Prime Minister Benjamin Netanyahu is expected to meet Trump at the White House as well later today to discuss the president’s 21-point peace plan for Gaza.

-

Fed speakers: Federal Reserve Board governor Christopher Waller speaks at a conference in Frankfurt, Germany, while Federal Reserve Bank of Cleveland president Beth Hammack will also be in the German city, participating on a panel hosted by the European Central Bank. Federal Reserve Bank of St Louis president Alberto Musalem speaks at an event entitled “The Past, Present and Future of the Federal Reserve”. Atlanta’s Federal Reserve Bank president Raphael Bostic moderates a discussion on Atlanta’s economy with Delta Air Lines chief executive Ed Bastian.

-

Economic data: Argentina releases second-quarter current account data.

-

Results: Cruise line operator Carnival and investment bank Jefferies Financial report third-quarter results. Entrepreneur Charlie Javice is to be sentenced for defrauding JPMorgan into buying college aid start-up Frank for $175mn in July 2021.

-

Charlie Kirk murder: Tyler Robinson, the suspected killer of the conservative activist, is scheduled for an in-person preliminary hearing in his case.

Five more top stories

1. The chair of Wall Street’s top watchdog has pledged to pursue a minimum “dose” of regulation and fast-track President Donald Trump’s proposal to scrap quarterly corporate reporting. Paul Atkins, who was appointed by Trump in the spring, said that he would look at the option of semi-annual corporate reporting in place of the current requirement.

-

In his own words: The chapter of mission creep at the SEC has closed, Atkins writes in an FT column.

2. First Brands Group has filed for bankruptcy protection while disclosing more than $10bn in total liabilities, marking one of the most spectacular collapses in private debt markets in recent years. Read more about the bankruptcy filing that has raised concerns over riskier lending on Wall Street.

3. AstraZeneca plans to elevate its New York listing in a blow to London, as one of Britain’s biggest companies accelerates its pivot to the US. The UK’s largest drugmaker announced a significant shake-up earlier today that will lead to it listing its shares directly on the New York Stock Exchange. Here’s more on the announcement.

4. The world’s top artificial intelligence groups are stepping up their focus on so-called world models that can understand human environments better, in the search for new ways to achieve machine “superintelligence”. Here are the companies developing systems that aim to navigate the physical world by learning from videos and robotic data.

5. Trump’s “unpredictable” policymaking and immigration crackdowns have prompted some multinational businesses to consider relocating staff from the US or diverting activity away from the world’s largest economy, according to executives and their advisers. Read more on how policy shifts are hitting boardroom sentiment.

The Big Read

The prosecutors of the Southern District of New York, who play a central role in policing white-collar crime, once took pride in its independence. But prosecutors say that as a result of pressure from the Trump administration lawyers at SDNY are demoralised and fearful that cases will not be prosecuted. Preliminary data about SDNY’s cases supports some of these fears.

We’re also reading . . .

-

Stephen Miller: Trump’s ‘prime minister’ is America’s most powerful unelected bureaucrat and the architect of the US president’s plan to remake America.

-

Citigroup: The former JPMorgan banker Vis Raghavan was a surprise pick to run and fix Citi’s investment bank. A year in, he sits down with the FT.

-

The ‘tradwife’ fantasy: Economic stress is one reason traditional gender roles have a political and emotional allure, writes Rana Foroohar.

-

Hong Kong: Democracy activist Nathan Law was denied entry to Singapore over the weekend.

-

🎬‘Jobpocalypse’: What will the future of work look like if there are fewer starter jobs and middle management positions? Isabel Berwick, author of the Working It newsletter, explores this question in a new FT video.

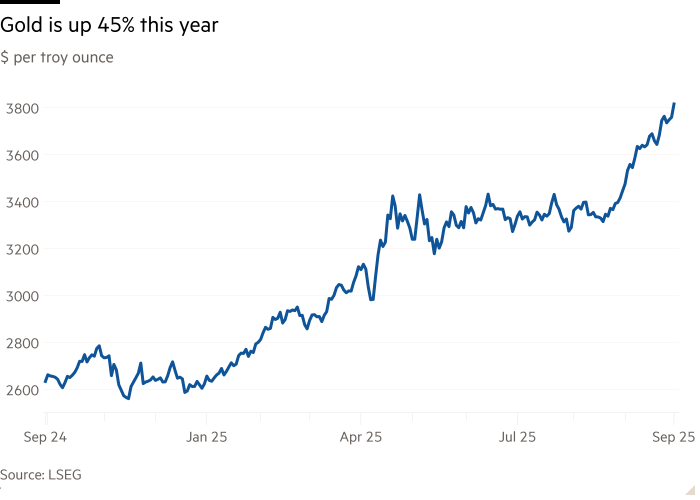

Chart of the day

Gold prices punched through $3,800 per troy ounce this morning, fuelled by concerns over government debt levels and inflation and by questions over the status of the US dollar as a reserve asset. Bullion has been on a blistering rally this year, recording gains of 45 per cent helped by a recent surge in gold-backed exchange traded funds. Leslie Hook, the FT’s natural resources editor, reports.

Take a break from the news . . .

. . . and dream of the slopes. Deep in British Columbia, Canada, a pioneering new version of ski touring is taking shape. Tim Robbins signed up for the chance to visit the remote wilderness where history records a prospector once fought off a grizzly bear, giving the high mountains and deep valleys their name — the Battle Range.