Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

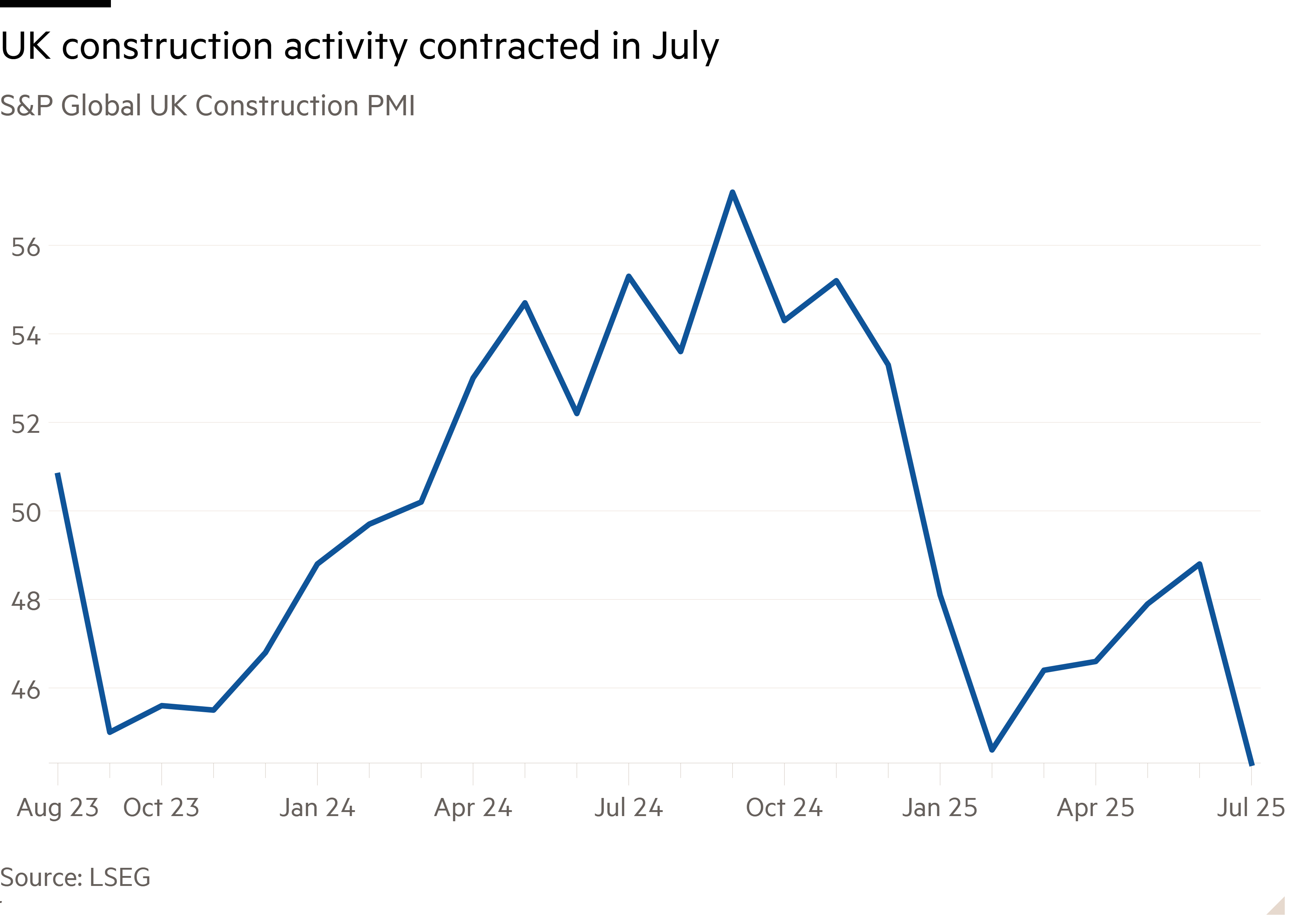

UK construction activity in July fell at the sharpest rate since 2020, dragged down by a drop in housebuilding and undermining a key government pledge to boost the number of homes built.

S&P Global’s UK Construction Purchasing Managers’ index, a closely watched gauge tracking activity in the sector, showed a fall in July to 44.3, down from 48.8 in June, the steepest drop since May 2020. A number below 50 signals a contraction in activity.

The fall exceeded economists’ expectations for a flat reading, in a London Stock Exchange Group poll.

Civil engineering and commercial construction activity both contracted, S&P noted on Wednesday, “but a considerable drag came from a fresh drop in residential building”. Construction businesses cited site delays, fewer new orders and weaker customer confidence.

Joe Hayes, principal economist at S&P Global Market Intelligence, said that UK constructors were preparing for “challenging times” ahead.

“They’re buying less materials and reducing the number of workers on the payroll,” he said. “Expectations also continue to underwhelm, despite a modest pick-up in confidence from June’s two-and-a-half-year low.”

Composite data also published by S&P Global on Wednesday, which includes manufacturing and services, fell slightly to 50.8 in July from 51.7 the previous month.

Economists said the gloomy construction survey could signal a loss of momentum in the economy in the third quarter, but added that the figures should be treated with caution because the PMI data can often be erratic.

Matt Swannell, chief economic adviser to the EY Item Club, said the data was at odds with official estimates of construction output, which had increased in the year to date, and that the drop in business confidence could reflect broader unhappiness over global trade policy and UK taxes.

But Swannell added that the sector still faced a “challenging outlook” as uncertainty led to project cancellations and labour costs remained high.

Elliott Jordan-Doak, at the consultancy Pantheon Macroeconomics, said he expected sentiment to improve in the coming months, on the back of a likely interest rate cut from the Bank of England later this week, and as the government increased investment spending and planning reforms.

Brian Smith, head of cost management and commercial at the infrastructure consultancy Aecom, said the market remained cautious, with clients holding back decisions due to cost and capacity concerns.

A clearer direction from the government on infrastructure plans was helping to steady sentiment, Smith added, but labour shortages remained a challenge and “the scale of what’s in the pipeline cannot be delivered without the right capacity in place”.

Max Jones, director of infrastructure and construction at Lloyds Banking Group, said that “despite a challenging month”, the sector was now showing signs of recovery, with inflation in core material costs easing and project pipelines improving.