Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

After years on the back foot, the owners of London’s Canary Wharf estate are enjoying a run of positive headlines. Visa has been in talks to move its European headquarters there, Spanish bank BBVA is expanding its office and HSBC reversed plans to abandon the area.

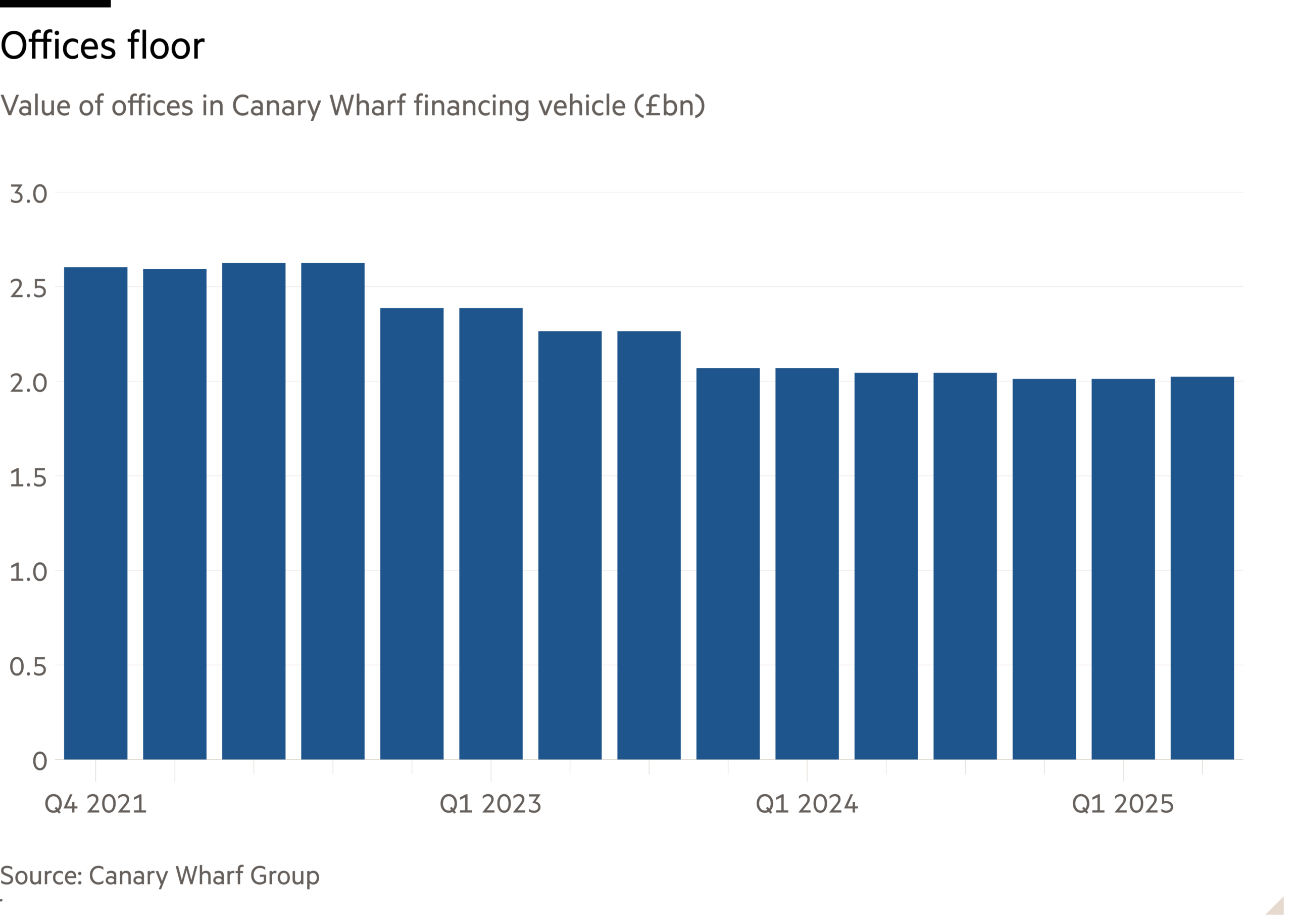

A few good news stories might be dismissed as spin, but data suggests there really is the beginning of a turnaround for Canary Wharf Group. Valuations of its offices are improving for the first time in three years, while leasing volumes year-to-date have already surpassed the annual totals for 2022 and 2023 and are on track to top 2024.

The value of a portfolio that CWG used as collateral crept up 0.6 per cent between March and June. That might not sound like much, but it will be welcomed by owners Brookfield and the Qatar Investment Authority after 11 consecutive quarters of stagnant or falling valuations. The £2bn portfolio includes about half of CWG’s total office holdings, so should give a decent insight into the broader trend.

Office prices had been hit by a combination of rising interest rates and concerns about long-term demand after the Covid-19 pandemic. Now, however, both those pressures are easing.

Valuations at rivals started rising last year, but it is not surprising that Canary Wharf is taking longer to recover. Since the pandemic, large companies have prioritised transport links and extra amenities. That helped city centre landlords such as Derwent London and Great Portland Estates at the expense of the Docklands, which has a reputation for being a bit out of the way and soulless.

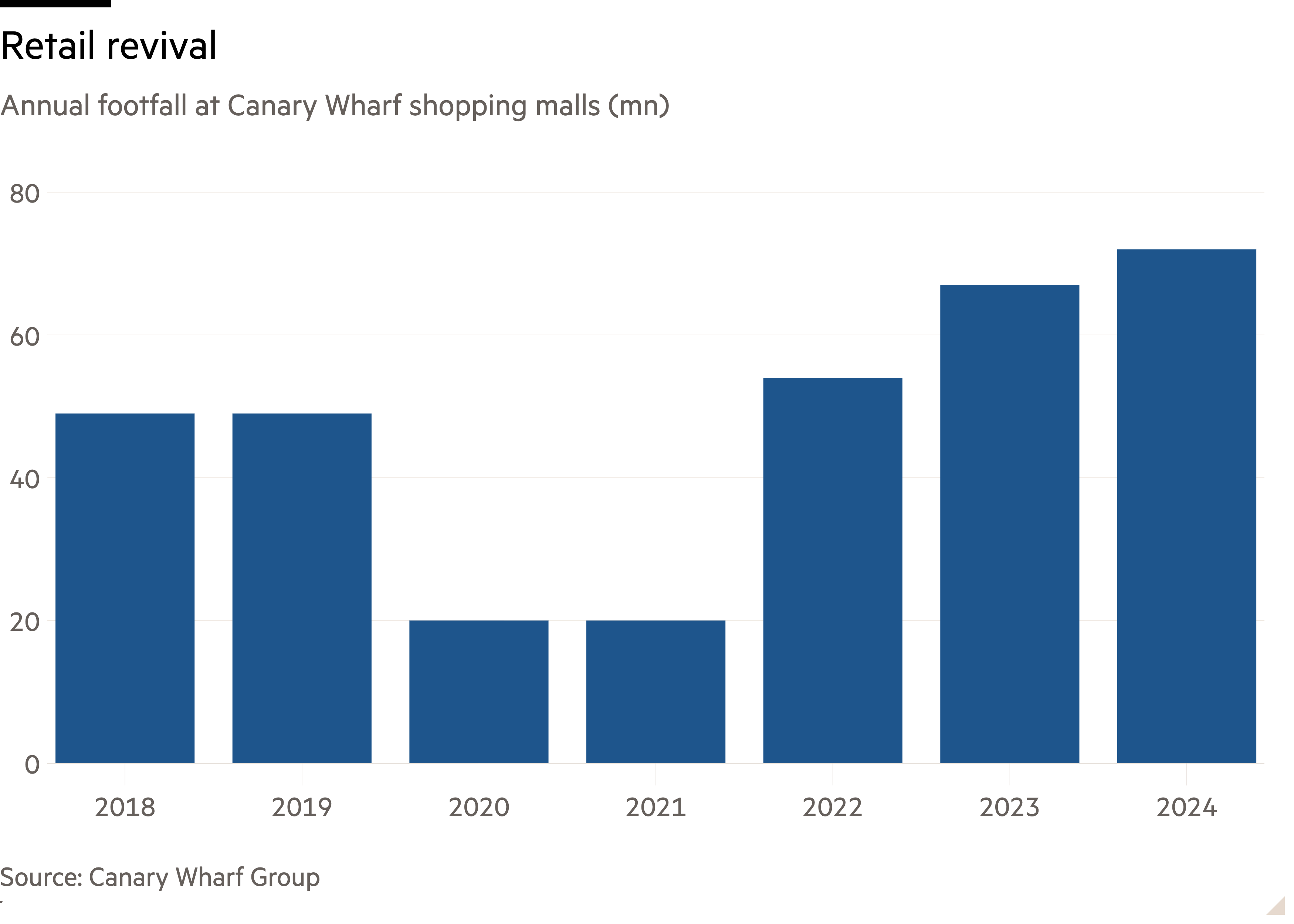

But Canary Wharf is at least on the Elizabeth Line, now the most popular London commuter route. And while the centre had a head start on the cultural front — the City is already, well, a city — CWG has been trying to catch up, with investments in housing, retail and leisure making it feel more lively. Stroll through the streets now and you are as likely to see pushchairs as power lunchers.

HSBC’s announcement, in particular, reflected a pattern helping high-end developers across Europe — there just is not enough space around of the quality demanded by major multinationals. The bank is moving to a new HQ in the City in 2027, but leased an additional office in Canary Wharf for extra room.

In that respect, good news for Canary Wharf is a good sign for its listed rivals too, since they should benefit from the same shortages. Derwent said as much earlier this week, telling analysts “there is a significant shortage of supply . . . [while] demand remains well above the long-term average”.

The positivity is yet to show up in share prices, however. Derwent trades at a more than 40 per cent discount to book value, providing a reminder of one area where CWG has the advantage: it can concentrate on working and enjoy the higher rents instead of battling to convince public markets about it.