Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Siemens Energy said it had amassed a record order backlog of almost €136bn thanks to “enormous” demand for electricity driven by new data centres being built in the US.

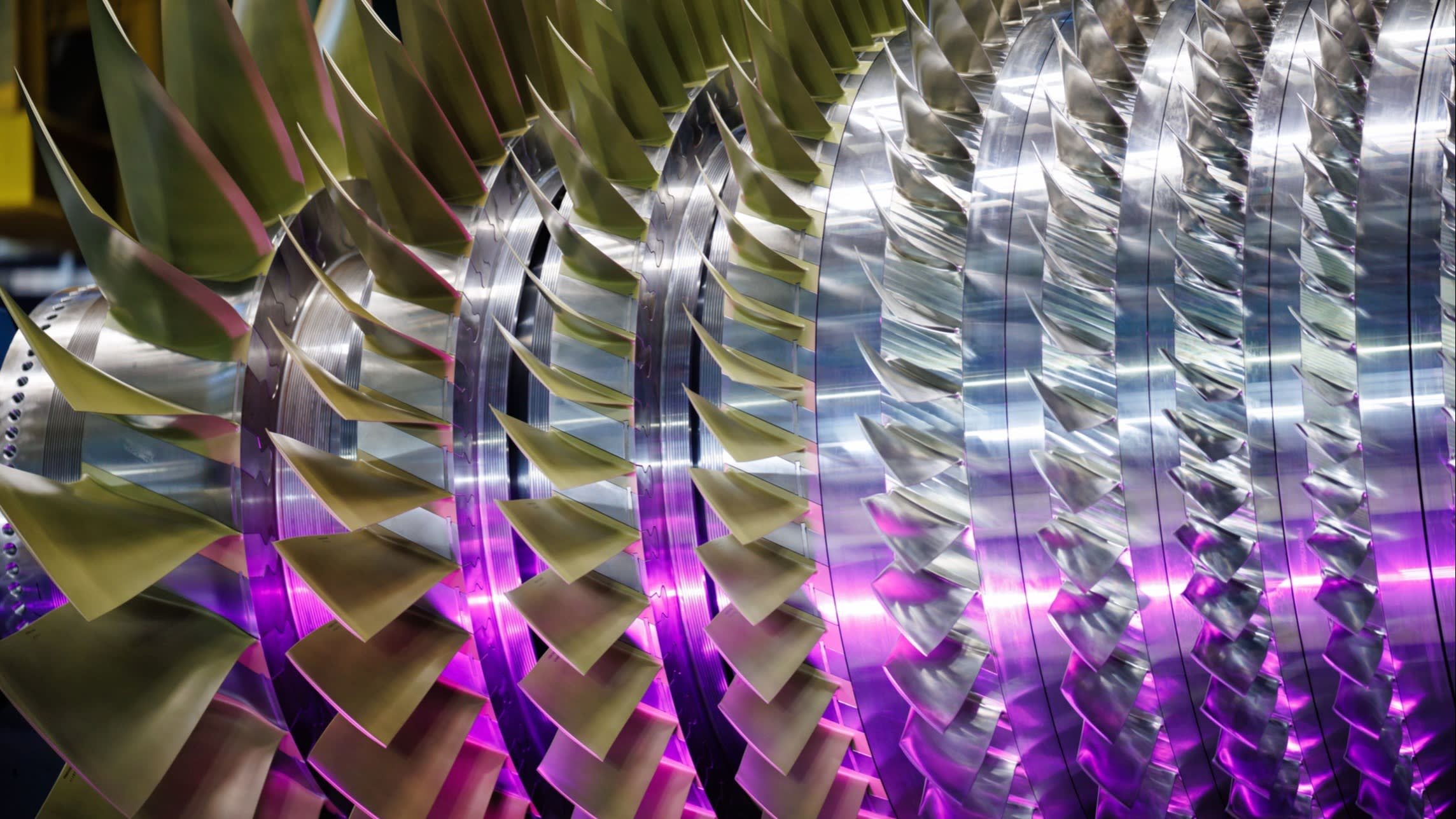

The German maker of gas turbines and power grid equipment predicted on Wednesday that it would hit the upper end of its revenue target this year, having raised its outlook for growth to between 13-15 per cent in April.

“Enormous demand for electricity for data centres in particular are now driving very high demand for our products in the US,” chief executive Christian Bruch told reporters. He added that 60 per cent of its 14 gigawatts of gas turbine orders in the year to date were for data centres.

As well as equipment for gas-fired power stations, Siemens Energy also makes wind turbines and equipment and technology to distribute electricity, with factories based around the world including in Europe and the US.

Its products are in high demand owing to the need to replace ageing equipment as well as rising demand for electricity from power-hungry data centres, air conditioning, and efforts in some countries to move towards electric cars and heating powered by renewable electricity.

The company’s shares are sensitive to expectations of data centre demand, driven by the boom in artificial intelligence. They were hit when Chinese AI start-up DeepSeek shocked Silicon Valley in January with advances apparently achieved with far less computing power than US rivals.

Shares have since risen sharply, and are up 90 per cent in the year to date. The stock was broadly flat in mid-morning trading on Wednesday.

The company is recovering from a difficult period in 2023 when it had to turn to the German government for financial guarantees as technical problems with its wind turbines triggered confidence questions.

A ban on dividend payouts as a result of those problems were lifted last week, and shareholders will decide in February 2026 whether to pay a dividend for 2025.

Siemens Energy announced its “highest ever” quarterly order intake of €16.6bn, leading to the record overall backlog of €136bn. Bruch said robust orders were helping the company to offset the impact of US tariffs, which added an extra €100mn in levies in the three months to the end of June.

Siemens Energy forecasts a “mid-double-digit million-euro” hit in the fourth quarter following a trade deal signed last month between the EU and US. The US accounted for about 35 per cent of Siemens Energy’s orders in the quarter.

Bruch said that while the agreement was a “significant step” it would “naturally have preferred to avoid”, the deal at least provided some certainty it could plan around.

“Given the strong operating performance we can compensate for the additional burden, but it is still a painful process,” he said.

The company reported a 13.5 per cent rise in revenues year on year, to €9.7bn, and net income of €697mn, up from a €102mn loss in the same quarter of 2024.

Its wind turbine unit, Siemens Gamesa, was boosted by two orders for large offshore projects in the Baltic Sea, worth a combined €3.3bn.