This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT. Here are today’s highlights:

-

US slaps punitive tariffs on India

-

China seeks to triple AI chip output

-

Iranians yearning for change

-

New York’s Waldorf Astoria prepares to reopen

The US has slapped punitive tariffs on India over its purchases of discounted Russian oil. The 25 per cent levy, which came on top of a 25 per cent “reciprocal” tariff, took effect at 12.01am US eastern time today. Here’s what you need to know.

What will be the effect of the tariff? India is now among the worst-hit countries of Trump’s tariff war, with overall duties on a par with Brazil’s and higher than those for China. The Global Trade Research Initiative, a New Delhi-based think-tank, said textiles, gems, jewellery, shrimp and carpets would be worst affected. Semiconductors, consumer electronics and pharmaceuticals will be covered by separate, sector-specific US tariffs. Standard Chartered has forecast that the tariffs could knock as much as 1 percentage point off India’s GDP growth.

Why it matters: The US is India’s largest trading partner, with two-way trade in goods worth more than $130bn in the financial year ended in March. But the White House accuses New Delhi of funding Vladimir Putin’s war in Ukraine by purchasing Russian crude oil. India has struck a defiant tone in the face of Trump’s tariff threats, saying that “the targeting of India is unjustified and unreasonable”. Relations have cooled between Trump and Narendra Modi while at the same time Indian officials have made overtures to Russia and China. The Indian prime minister is expected to visit China for the first time in seven years this weekend for a regional security summit which will also be attended by Putin. Read more on today’s developments.

-

Trade tracker: For an overview of the US tariff rates, including a timeline, click here.

Here’s what else we’re keeping tabs on today:

-

Gaza: Trump is expected to chair a meeting at the White House today on Gaza, according to US special envoy Steve Witkoff, without providing any more details. Separately, secretary of state Marco Rubio will meet Israeli foreign minister Gideon Saar in Washington, the state department said.

-

Company earnings: Wall Street’s faith in the artificial intelligence boom will be put to the test when Nvidia unveils its second-quarter earnings report. Canada’s Dollarama, Abercrombie & Fitch, cyber security company CrowdStrike Holdings and Snowflake also report second-quarter earnings. J M Smucker reports first-quarter results and HP Inc releases earnings for its third quarter.

Five more top stories

1. China’s chipmakers are seeking to triple the country’s total output of artificial intelligence processors next year, as domestic groups such as DeepSeek push for the semiconductors needed to match western rivals in developing the most advanced AI. Chinese companies are also racing to develop the next generation of AI chips. Zijing Wu in Hong Kong has more.

-

More AI news: OpenAI’s corporate restructuring is likely to slip into next year, as the ChatGPT maker negotiates over key terms of its future relationship with Microsoft.

2. Donald Trump’s push to fire a top Federal Reserve official is heading for a high-stakes legal test of the independence of the world’s most important central bank. Speaking yesterday at a televised cabinet meeting that lasted more than three hours, the US president defended his move to fire Fed governor Lisa Cook.

-

FT View: The US president should remember that he was elected, in part, on a wave of public loathing for inflation — precisely what he risks letting loose with tighter control of the Fed.

3. The US has said it is prepared to provide intelligence assets and battlefield oversight to any western security plan for postwar Ukraine as well as take part in a European-led air defence shield for the country, officials stated. The US offer represents a significant shift in stance by the Trump administration — earlier this year it ruled out any US participation in protecting post-conflict Ukraine.

4. Apollo Global Management has lent millions of pounds secured against assets, including racehorses and stables, to a company owned by football “super agent” Kia Joorabchian. The unorthodox lending marks the US private capital group’s latest deal with a prominent player in Europe’s footballing landscape. Euan Healy has the details.

5. SpaceX has launched its massive Starship rocket on its 10th test flight, with the spacecraft detaching from the lower-stage booster and deploying eight dummy Starlink satellites into orbit. The successful mission breaks a streak of costly failures and reinforces Elon Musk’s dominance of commercial space flight.

The Big Read

Israel’s war against Iran in June momentarily galvanised a polarised society in its opposition to a foreign aggressor. The sense of solidarity both surprised the autocratic leadership and delivered it a vital boost during its darkest hours. Despite the initial mood, Iranians across the political spectrum believe the conflict has exposed the vulnerabilities of the system.

We’re also reading . . .

-

A Kodak moment?: With everyone on diet drugs, WeightWatchers is under pressure to prove that it has not fallen behind the times, writes Brooke Masters.

-

Mexico: An election in Pantelhó, in the southern Mexican state of Chiapas, this Sunday will test President Claudia Sheinbaum’s crackdown on the drug cartels.

-

Fending off the far right: Progressives should be concerned about why democracy isn’t delivering, author Marc Dunkelman writes.

-

De Beers sale: Botswana has hired French bank Lazard as it looks to take control of the diamond miner, days after the country received a $12bn investment pledge from Qatar.

Chart of the day

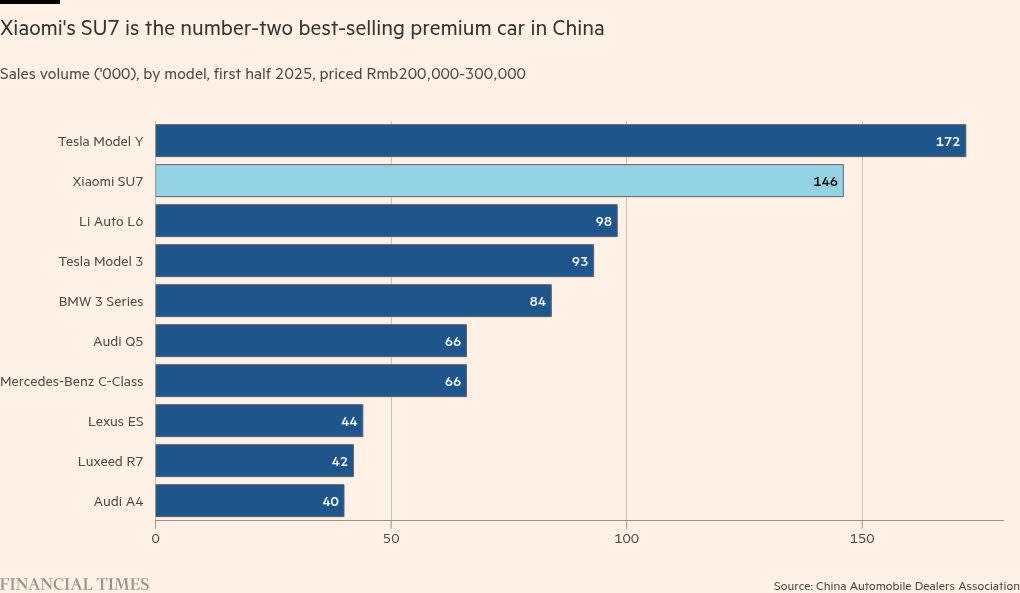

Xiaomi, initially dismissed as an “assembly workshop”, has overtaken rivals to become the world’s third-largest handset seller. The Chinese group is now setting its sights on becoming a high-tech manufacturer, producing foldable smartphones in-house, and recently, a vastly popular premium car. Read more on the Chinese gadget maker taking on Tesla and Apple.

Take a break from the news . . .

After an eight-year closure and a reputed $2bn renovation, New York’s Waldorf Astoria hotel is glittering again. A soft launch in July saw the opening of its new restaurants, lobby bar and guest rooms, while the whole hotel — ballrooms, spa and all — officially opens on September 1. The FT’s architecture critic Edwin Heathcote was among the first to stay in the revamped hotel. Here’s his review.